Customer Services

Copyright © 2025 Desertcart Holdings Limited

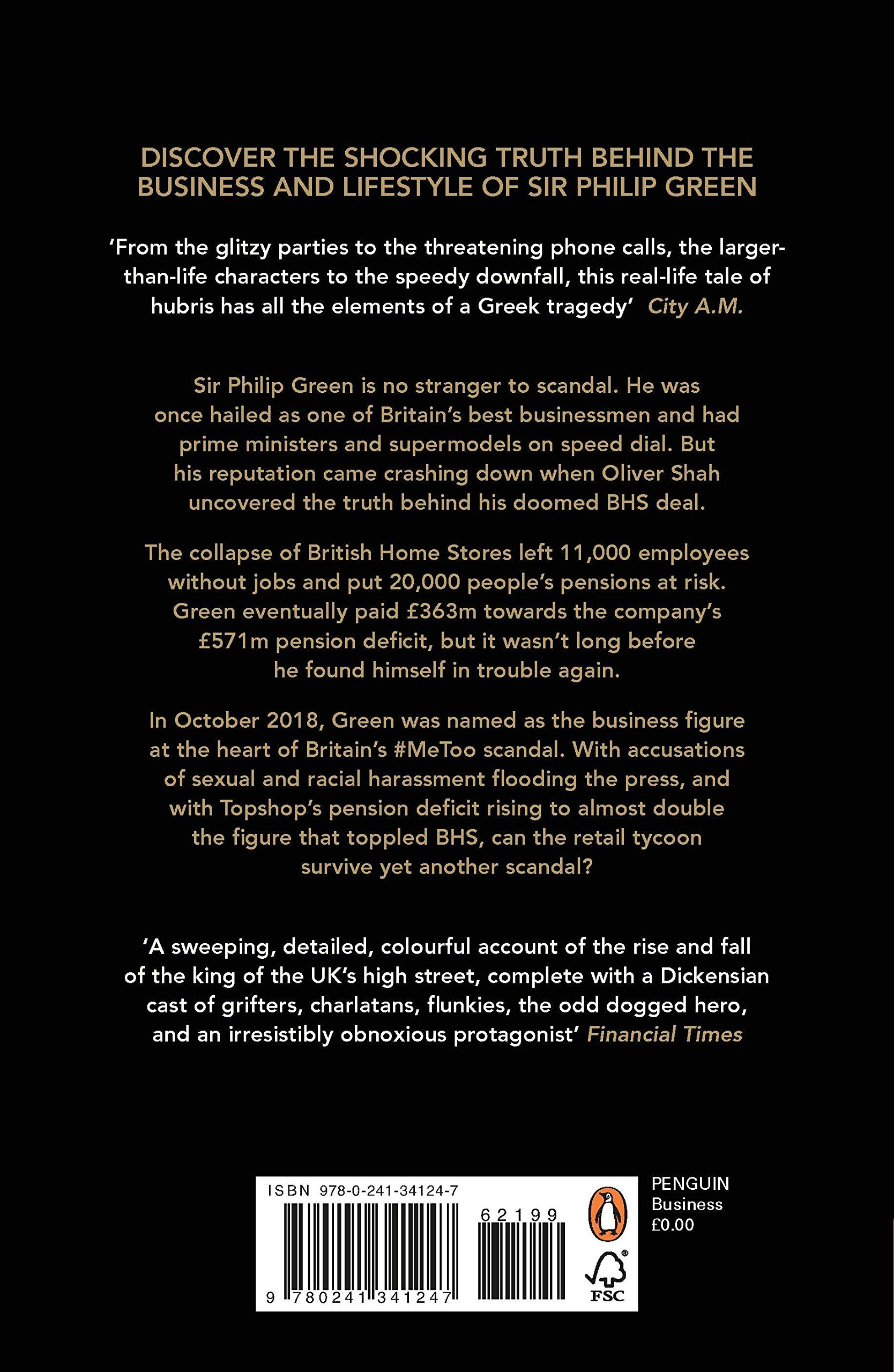

Buy Damaged Goods: The Rise and Fall of Sir Philip Green - The Sunday by Shah, Oliver online on desertcart.ae at best prices. ✓ Fast and free shipping ✓ free returns ✓ cash on delivery available on eligible purchase. Review: The book delivers a forensic yet pacey exposé of Sir Philip Green’s rise and catastrophic fall. It exposes how Britain’s once-lauded retail king engineered the £1 sale of BHS, stranded 11,000 employees, and left a £571 million pension hole. The author spent two years digging into Green’s offshore empire, boardroom tactics and lifestyle excesses. His direct access to leaked documents, former insiders and regulatory filings underpins a narrative that feels both blockbuster and meticulously reported. Key Revelations - £1 Sale to a Charlatan. In March 2015, Green sold BHS to serial bankrupt Dominic Chappell for just £1. Within a year, BHS amassed £1.3 billion in debts—including a £571 million pension deficit—triggering the largest high-street insolvency of modern times. - Pension Desertion and Final Settlement Green initially withheld pension support, forcing the Pensions Regulator to pursue him. In 2017 he agreed to pay £363 million into BHS’s depleted fund—still far short of the total shortfall. - Asset-Stripping Playbook The book dissects Green’s modus operandi: aggressive cost-cutting, off-shoring jobs, selling off property and brands. Each chapter underscores how greed eclipsed any sense of stewardship over staff or community. - From Green’s glitzy supermodel soirées to menacing late-night calls, Shah populates the book with a Dickensian cast of cronies, crooked advisers and the odd hero. The prose races like a Greek tragedy—bright, brutal and darkly entertaining. - Deal-making vs. Going Concern Despite Green’s flair for headline-grabbing takeovers, the book lays bare his inability to manage companies as going concerns. Each empire he built faltered soon after acquisition—exposing operational neglect beneath the deal-making bravado. Well worth reading Review: For a long time my opinion of Sir Philip Green was that of a very competent entrepreneur who was fast mastering the art of turning our poorly performing retail clothing sector into efficiently run profit centres fit for purpose in today's High Street versus internet battle. And in doing so I was unconcerned that he was pocketing high rewards for his successes. After reading this book I saw Sir Philip in a completely different light none of which covered him in a positive glow, quite the contrary it exposes him as a foul mouthed, bullying, extremely greedy , boastful and generally unpleasant person. Whilst this book is very well put together and accurate ( I say this because Sir Philips often used in the past to suppress negative news team of highly paid top lawyers have thus far seemingly not challenged the authenticity of this book) it does burst the bubble of belief that he is a clever business leader and an example to be followed. Quite the opposite under no circumstances should his style of running a business be copied unless the sole intent is to bleed a company dry of financial resources and then throw it to the wolves! A very good and interesting book but nevertheless the exposure of Philip Green's bully boy money grasping mentality is depressing and a very poor example of how some entrepreneurs conduct themselves.

| Best Sellers Rank | #157,103 in Books ( See Top 100 in Books ) #119 in Retailing Industry #207 in Business Ethics #509 in Women's Studies |

| Customer reviews | 4.6 4.6 out of 5 stars (187) |

| Dimensions | 12.7 x 2.29 x 19.69 cm |

| Edition | 1st |

| ISBN-10 | 0241341248 |

| ISBN-13 | 978-0241341247 |

| Item weight | 256 g |

| Language | English |

| Print length | 352 pages |

| Publication date | 28 March 2019 |

| Publisher | Penguin |

S**T

The book delivers a forensic yet pacey exposé of Sir Philip Green’s rise and catastrophic fall. It exposes how Britain’s once-lauded retail king engineered the £1 sale of BHS, stranded 11,000 employees, and left a £571 million pension hole. The author spent two years digging into Green’s offshore empire, boardroom tactics and lifestyle excesses. His direct access to leaked documents, former insiders and regulatory filings underpins a narrative that feels both blockbuster and meticulously reported. Key Revelations - £1 Sale to a Charlatan. In March 2015, Green sold BHS to serial bankrupt Dominic Chappell for just £1. Within a year, BHS amassed £1.3 billion in debts—including a £571 million pension deficit—triggering the largest high-street insolvency of modern times. - Pension Desertion and Final Settlement Green initially withheld pension support, forcing the Pensions Regulator to pursue him. In 2017 he agreed to pay £363 million into BHS’s depleted fund—still far short of the total shortfall. - Asset-Stripping Playbook The book dissects Green’s modus operandi: aggressive cost-cutting, off-shoring jobs, selling off property and brands. Each chapter underscores how greed eclipsed any sense of stewardship over staff or community. - From Green’s glitzy supermodel soirées to menacing late-night calls, Shah populates the book with a Dickensian cast of cronies, crooked advisers and the odd hero. The prose races like a Greek tragedy—bright, brutal and darkly entertaining. - Deal-making vs. Going Concern Despite Green’s flair for headline-grabbing takeovers, the book lays bare his inability to manage companies as going concerns. Each empire he built faltered soon after acquisition—exposing operational neglect beneath the deal-making bravado. Well worth reading

D**R

For a long time my opinion of Sir Philip Green was that of a very competent entrepreneur who was fast mastering the art of turning our poorly performing retail clothing sector into efficiently run profit centres fit for purpose in today's High Street versus internet battle. And in doing so I was unconcerned that he was pocketing high rewards for his successes. After reading this book I saw Sir Philip in a completely different light none of which covered him in a positive glow, quite the contrary it exposes him as a foul mouthed, bullying, extremely greedy , boastful and generally unpleasant person. Whilst this book is very well put together and accurate ( I say this because Sir Philips often used in the past to suppress negative news team of highly paid top lawyers have thus far seemingly not challenged the authenticity of this book) it does burst the bubble of belief that he is a clever business leader and an example to be followed. Quite the opposite under no circumstances should his style of running a business be copied unless the sole intent is to bleed a company dry of financial resources and then throw it to the wolves! A very good and interesting book but nevertheless the exposure of Philip Green's bully boy money grasping mentality is depressing and a very poor example of how some entrepreneurs conduct themselves.

J**W

Most of the collapse of BHS (and Phillip Green's reputation) have been reported on exhaustively, not least by Oliver Shah. It was how he got there that made the first 2/3rds of the book compelling reading. A couple of details may or may not have been added in the interest of amusing the reader at the expense of precise accuracy. Given the number of incontrovertible facts that might otherwise be mistaken for fiction, these certainly don't detract from the overall enjoyment of an extraordinary story of rapacity piled on avarice, liberally sprinkled with old fashioned greed.

S**Y

I really enjoyed the book but felt it was released too soon as Arcadia group including Top Shop went bust shortly afterwards and would have given the book a better ending.

R**Y

Good rounded picture of Green and wheeler dealers of the large corporate world. Perhaps a little too much repetition and not enough said on how Green's greed was not the only driving force behind the fall of BHS, but was at least to a significant degree caused by economic policy, taxation changes but of course also due to Green not seeing the need to maintain sufficient level of reserves on the balance sheet. This man's behavior/ego/arrogance does show why some choose to decline the offer of a knighthood. He created a lot of wealth but also a lot of misery too. But of course success, especially at that level is not for meek minded people.

Trustpilot

3 weeks ago

2 months ago